While our country’s approach to all student lending needs a radical overhaul, there is one category of lending that sticks out as especially broken: graduate-student loans. Since the turn of the century, undergraduate lending has increased marginally from $37 billion a year to $43 billion. In contrast, graduate lending more than doubled, from $18 billion to $39 billion a year. Graduate lending has increased so rapidly that it will soon dominate the lending portfolio. The Congressional Budget Office (CBO) projects that, over the next 10 years, undergraduate lending will total $421 billion, while graduate lending will total $522 billion.

Why are graduate loans so bad?

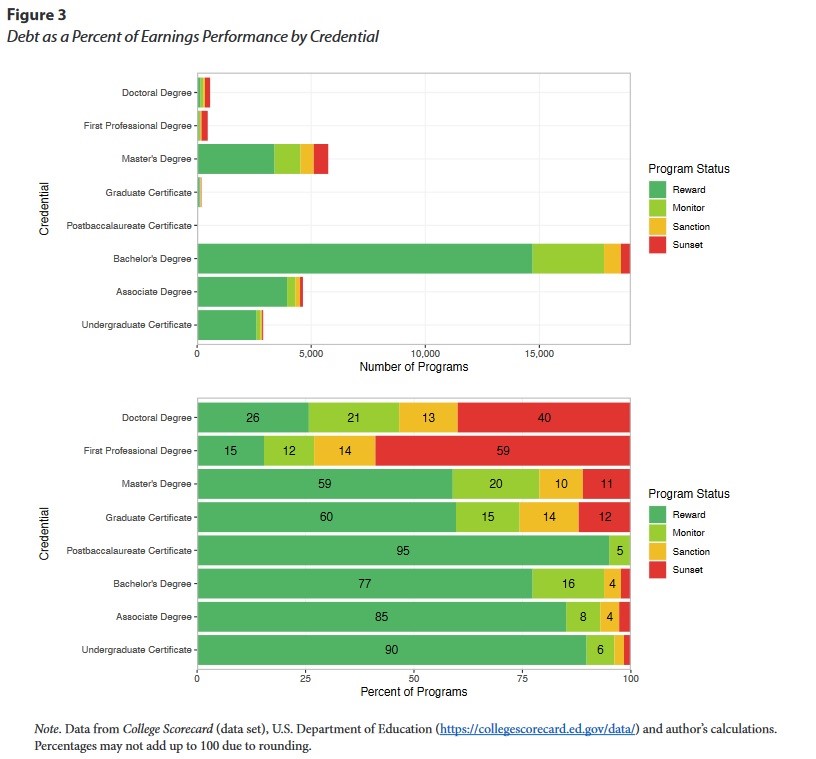

High lending volume is not necessarily a problem. If all that lending were facilitating wise and productive investments in human capital, it could even be a cause to celebrate. Unfortunately, that is not the case. Analyses by Preston Cooper, Jason Delisle and Jason Cohn, and myself have demonstrated that a disturbingly high share of graduate programs are dangers to their students and taxpayers (a “program” is a college, major, and credential combination, such as a bachelor’s degree in nursing from Texas A&M). For example, one potential accountability system, which would punish college programs whose graduates are unable to repay their student loans, would sanction or sunset the majority of professional and doctoral degree programs, as seen in the reproduced figure below.

The poor performance of graduate programs makes the large and rapidly growing volume of graduate lending a problem.

But students aren’t the only ones harmed by these failing programs. Taxpayers lose out, too, because when loans are not repaid, the taxpayers have to fill the gap. Indeed, the CBO estimates that taxpayers will lose 16 to 28 cents of every dollar lent to graduate students over the next 10 years, under Federal Credit Reform Act accounting standards. Under the more realistic fair-value accounting standards, this increases to 24 to 34 cents.

What caused these troubling trends?

There are two main drivers of these changes in graduate lending. The first is the expansion of PLUS loan eligibility to graduate students. Students have been able to borrow under the main (Stafford) loan program for decades. Notably, these loans have safeguards to prevent overborrowing, in particular annual and aggregate borrowing limits that ensure that most students can’t borrow too much. While not perfect, these safeguards make undergraduate loans relatively safe. Graduate lending under the Stafford program was a little riskier, due to higher annual limits ($20,500 compared to $7,500 for dependent undergraduates and $12,500 for independent undergraduates) and aggregate limits ($138,500 compared to $31,000 for dependent undergraduates and $57,500 for independent undergraduates).

The poor performance of graduate programs makes the large and rapidly growing volume of graduate lending a problem.But in 1980, Congress established the PLUS loan program, which allowed parents to borrow to help finance their child’s education. Over the years, the safeguards on PLUS loans disappeared, and there is no annual or aggregate limit on borrowing. Technically, the annual limit is a college’s Cost of Attendance (CoA), but each college determines its own CoA, and there is no limit on that determination. Overborrowing among parents is thus disturbingly common.

To make matters worse, in 2006, Congress expanded the PLUS program to allow graduate students to borrow. This means that graduate students can borrow without limits on both an annual and an aggregate basis. When you read about people with hundreds of thousands in student-loan debt, Grad PLUS is the reason.

The second driver is extremely generous income-driven repayment (IDR) programs. Income-driven repayment programs determine monthly student-loan payments as a percentage of a student’s income, rather than on the basis of how much they borrowed (e.g., 10 percent of income a month instead of $250 a month). Under a traditional loan, everyone repays for the same amount of time, but the size of their payment varies based on how much they borrowed. Under an income-driven repayment loan, conversely, everyone repays the same share of their income each month, while the number of years they make payments varies based on how much they borrowed.

Income-driven repayment is a great idea in theory, but the U.S. has terribly botched the implementation. The most glaring problem is that we’ve unnecessarily included extraneous loan-forgiveness provisions in these plans. By their nature, all IDR programs have built-in loan forgiveness. If you never make enough money to repay your loan, you get de facto grace. But we’ve also added additional forgiveness provisions, waiving any remaining balance after a certain number of years of repayment. This started at 25 years but has been lowered with each new iteration and is now as few as 10 years. In addition, the percentage of income that borrowers owe has also been reduced dramatically. The first IDR plan in the 1990s required 20 percent of income, whereas the most recent Biden IDR plan lowers it to 5 percent.

The result is a massive decrease in how much borrowers will repay. Again, whereas the first IDR plan required 20 percent of income for 25 years, the Biden IDR plan only requires 5 percent of income for as little as 10 years.

What should we do about graduate loans?

There are two main options for fixing graduate loans: replace the system, or reform the system.

Replacement

The best solution to both undergraduate and graduate lending problems is to replace the current system with private lending. Private lending has five key advantages over government lending.

- Less malinvestment: Private lenders will not continue to fund failing college programs year after year because they will lose money, whereas the government routinely does so.

- Greater accountability for colleges: Private lenders would punish colleges that leave their students with excessive debt by cutting off lending or offering worse lending terms, whereas the government doesn’t.

- Better incentives for students: Private lenders would offer stellar students and those who work hard discounts because they are less risky, but the government offers the same loan terms to everyone.

- Better incentives for colleges: Private lenders would reward colleges for incremental improvement, whereas the government does not.

- More informed decisionmaking due to differential pricing: Private lenders would price low-risk programs more generously than high-risk programs, providing valuable price signals to students about the relative risks of different majors, whereas the government uses uniform pricing.

Reform

If replacement is not feasible, then reform of the current system should be pursued. And given that the most problematic lending occurs under Grad PLUS, Grad PLUS should be the focus. There are four possible reforms that could fix or at least mitigate the problems with Grad PLUS loans.

1. Eliminate Grad PLUS loans.

My preferred solution is to end the Grad PLUS loan program. Recall that graduate students can already borrow up to $20,500 a year, and up to $138,500 in total (including undergraduate debt) under the traditional (Stafford) loan program. This is more than sufficient to finance most graduate education, and, in fact, eliminating Grad PLUS would leave most graduate students unaffected (only one out of six borrow from Grad PLUS) while at the same time eliminating the most extreme cases of debt, like the dentist who took on $1 million in student loans.

Colleges face no consequences when they leave students financially worse off. That should change.2. Cap Grad PLUS borrowing.

If eliminating Grad PLUS isn’t an option, the safeguards on Stafford loans (annual and aggregate limits) should be extended to PLUS loans. Financial experts recommend not borrowing more than your starting salary, and, unfortunately, the Stafford limit for graduate students ($138,500) is already too high for most programs. But for some programs, a higher aggregate limit could be justified, and the annual limit could be found by dividing by the typical time-to-degree. For example, if a program’s graduates typically earn $160,000, then the Grad PLUS limit for that program could be set to $21,500. (That sum plus the Stafford graduate limit of $138,500 equals $160,000.) If the typical time it takes to earn the degree is three years, the annual limit would be $7,167.

3. Make Grad PLUS loans ineligible for income-driven repayment.

Unlimited lending combined with generous loan-forgiveness provisions in income-driven repayment plans mean that graduate students will increasingly borrow even more, under the expectation that they will not need to pay it back. One way to fix this unsustainable situation is to make Grad PLUS loans ineligible for income-driven repayment plans. This would force graduate students to face the consequences of their borrowing, rather than allowing them to pass the cost onto taxpayers.

4. Require colleges to pay when students don’t.

Another option is to change the calculus for colleges. Right now, they face no adverse consequences when they offer low-quality programs that leave students financially worse off and taxpayers on the hook for losses on loans. That should change.

Colleges should be required to reimburse taxpayers for any losses on the loans made to their students. This would provide a safety net for students, prevent taxpayers from endlessly subsidizing underperforming programs, and ensure that colleges benefit from offering a program only when their students and taxpayers do, too.

The bottom line is that the status quo does not work. Replacement would work. Reform would work. But if graduate loans operate the same way in five years as they do now, policymakers will have failed us.

Andrew Gillen is a senior policy analyst at the Texas Public Policy Foundation.