When students take federal loans to pay for college, the government declares them to be in default if a student doesn’t make a payment for 9 months. According to the Department of Education, North Carolina has an 11.6 percent federal student loan default rate.

That rate is slightly higher than the national average of 11.3 percent. Among four-year institutions, the majority of high-default schools in the state are private non-profits, and almost half are historically black colleges and universities.

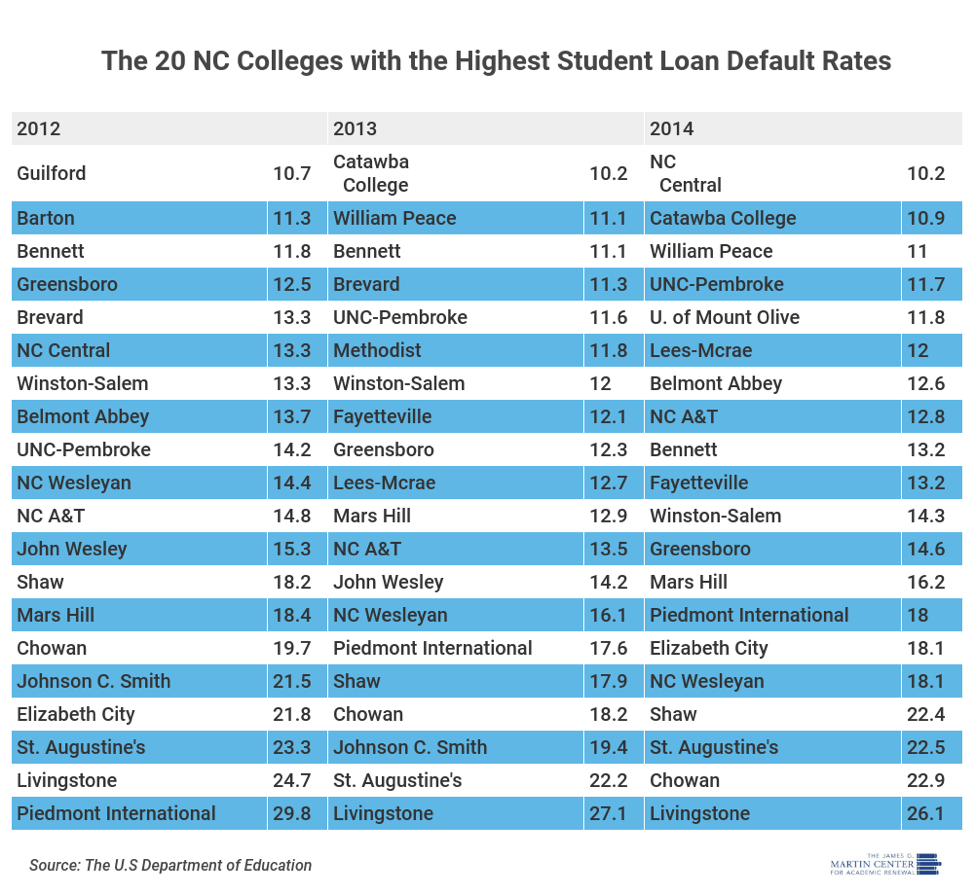

The three-year data, however, shows some promising trends. Default rates are measured in three-year averages because default rates can spike from year to year. The highest default rate fell by 3 percentage points from 2012 to 2014. Guilford and Barton Colleges lowered their default rates below 10 percent, and a few schools lowered their rates significantly. For example, Piedmont International University’s average student loan default rate fell by 11 percentage points. Doing so is a priority for any college with a high default rate: If their default rate is over 30 percent for three consecutive years, they lose all federal funding eligibility.

Not all colleges, unfortunately, improved their default rates. Livingstone College in Salisbury and St. Augustine’s College in Raleigh maintained some of the highest federal loan default rates in the state at 26.1 percent and 22.5 percent, respectively. Fellow HBCUs Elizabeth City State University and Johnson C. Smith University had dramatic changes in their default rates—ECSU went from 7.1 percent in 2013 to 18 percent in 2014, and Johnson C. Smith went from about 20 percent in 2013 to 2.1 percent in 2014.

There are a few reasons why default rates can change so dramatically. First, a change in tuition can change how much students borrow, which can affect default rates—although surprisingly, borrowers with smaller loans tend to default more frequently. Second, a school can offer more scholarships or grants in a particular year, or enroll more students who qualify for Pell Grants. Third, schools can lower their default rates by improving career services and counseling to ensure that students get good jobs after graduation.

There is still another possible reason for sudden and dramatic changes in student loan default rates. A 2018 report by the Government Accountability Office found that some colleges in danger of losing federal funding actively pushed students into forbearance, which “allows students to postpone making loan payments on a temporary basis,” even when it may not have been their best option. Entering into forbearance typically requires students to pay even more interest on their loans, but it prevents colleges from reporting defaults and losing funding eligibility. The release of the report caused pushback on the notion of using cohort default rates to judge colleges; whether they are completely accurate measures or not, it is clear that for many students today, enrolling in college is proving to be a costly and risky choice.

Madeline Baker was a Martin Center intern in summer 2019. She is pursuing a bachelor of science in International Economics and Finance with a minor in Spanish at the Catholic University of America in Washington, D.C.